If you’ve been watching the housing market from the sidelines, you’re not alone. Over the last few years, many buyers felt priced out, sellers felt stuck, and renters felt unsure about what comes next. Lately, you may have seen headlines claiming that 2026 will be a turning point for housing in the U.S. The real question is not whether something changes, but how those changes actually show up here in Maple Valley and Black Diamond.

This article breaks down what national forecasts are signaling, what matters locally, and how smart buyers and sellers should think about 2026 without relying on guesses or political promises.

Is 2026 expected to be a reset year for housing?

Many economists expect 2026 to feel less frozen than the past few years. Instead of dramatic price drops or runaway growth, the most likely outcome is stability.

Across the country, home prices surged roughly 55% from 2020 through 2025, according to national housing research from the National Association of Realtors and the Federal Housing Finance Agency. That pace was never sustainable.

What analysts are now projecting is a slowdown where:

Home prices move sideways or rise slightly

More homeowners list as they accept mortgage rates above 6%

Buyers gain negotiating room instead of facing bidding chaos

In plain terms, the market may finally feel functional again.

Will home prices fall in 2026?

A sharp nationwide drop is unlikely. Most forecasts point to prices staying close to current levels, with very modest growth. That matters because flat prices change the conversation. When prices stop racing ahead, timing and strategy start to matter more than speed.

Here in South King County, demand for space, newer homes, and access to schools continues to support values. Recent Northwest Multiple Listing Service (NWMLS) reports show that while sales activity slowed from peak years, median prices in much of South King County have remained relatively steady, and well-presented homes continue to attract strong buyer interest. Even if prices do not rise quickly, well-prepared homes still attract strong interest.

Key takeaway: waiting for a big price crash may keep you stuck, while steady conditions reward thoughtful planning.

What will happen with mortgage rates?

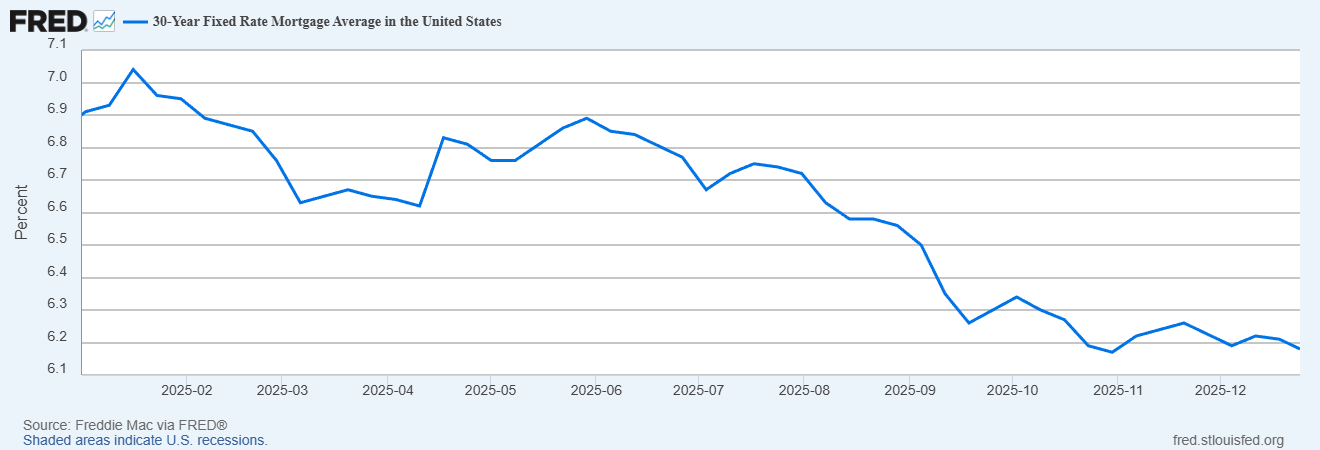

Mortgage rates cooled in late 2025 and are hovering just over 6%, reflecting broader trends tracked by Federal Reserve Economic Data and Freddie Mac’s Primary Mortgage Market Survey. Most projections keep them in that general range next year.

Rates matter, but predictability matters more. When buyers know what to expect, they plan. When sellers understand buyer budgets, pricing becomes clearer.

If rates drift slightly lower, that helps monthly payments. If they stay flat, confidence still improves because the guessing game ends.

How does inventory change the market?

One of the biggest shifts expected in 2026 has nothing to do with Washington, D.C. It has to do with people.

Many homeowners locked in very low rates years ago and delayed selling, a pattern widely noted by Redfin and Zillow Research. As more households adjust to today’s reality, listings increase. Even a modest rise in inventory creates breathing room.

For buyers, this means:

More choices

Less pressure to rush

More room for inspections and thoughtful offers

For sellers, it means presentation and pricing matter more than ever.

What about rent prices in 2026?

Rents leveled off in parts of the country during 2025, but forecasts suggest gradual increases may return, based on rental market tracking from Redfin and Apartment List. With ownership still expensive for many, rental demand remains strong.

This is one reason buyers are reconsidering ownership. Even if buying feels expensive upfront, predictable payments and long-term equity start to look more appealing when rent keeps rising.

How should buyers approach 2026?

Instead of asking “Should I wait?”, a better question is:

What would make buying make sense for my situation?

In a steadier market, buyers who prepare early tend to win. That means:

Understanding realistic monthly payments

Watching specific neighborhoods, not headlines

Being ready to act when the right home appears

2026 favors buyers who are informed and patient, not passive.

How should sellers think about timing?

Sellers no longer benefit from guessing high and hoping. The strongest results come from:

Pricing based on current data

Presenting the home clearly and professionally

Launching with a plan instead of testing the market

Even in stable conditions, homes that are positioned correctly stand out.

What this means for Maple Valley and Black Diamond

Local NWMLS data adds important context here. Recent NWMLS summaries indicate that inventory levels in South King County have increased modestly compared to prior years, giving buyers more options without flooding the market.

At the same time, average days on market have lengthened slightly, signaling a shift toward balance rather than distress. These trends support a market where pricing accuracy and preparation matter more than speed. National forecasts make headlines, but real estate decisions are local.

Here in South King County, buyers continue to look for space, access to schools, and a sense of community. Sellers benefit from steady demand, even when growth slows.

The biggest mistake We see is waiting for perfect clarity. That moment rarely arrives. What does arrive are windows where preparation pays off.

Frequently Asked Questions

Will 2026 be a better year to buy a home?

For many buyers, yes. Not because prices drop sharply, but because competition eases and choices improve.

Is it risky to sell if prices are flat?

Not if your pricing and marketing reflect current conditions. Flat markets reward accuracy.

Should I wait for mortgage rates to fall further?

Waiting can work, but it can also mean missing opportunities. The right move depends on your goals, not a headline rate.

Does national policy really affect local home values?

Long term, supply matters. Short term, local demand and inventory drive outcomes.

A steady market favors clear planning

If the past few years felt confusing, that’s understandable. 2026 is shaping up to reward clarity instead of speculation.

If you’re considering buying or selling in Maple Valley, or Black Diamond, let’s talk through your options with real numbers and a local view.

📧 clientcare@perkinsnwre.com | 🌐 www.perkinsnwre.com |📱 (206) 960-4985

Honest. Effective. Reliable.

Sources and market references

To keep this outlook grounded in real data, the insights above draw from a combination of national housing research and local market reporting:

National Association of Realtors (NAR) – housing price trends, affordability, and inventory data

https://www.nar.realtor/research-and-statisticsFederal Reserve Economic Data (FRED) – mortgage rate trends and long-term interest rate context

https://fred.stlouisfed.orgRedfin Housing Market Insights – home price movement, rent trends, and supply-demand analysis

https://www.redfin.com/news/data-center/U.S. Census Bureau – household formation and housing supply data

https://www.census.gov/housingNorthwest Multiple Listing Service (NWMLS) – local sales, pricing, and inventory trends for South King County

National data helps explain direction, but local conditions ultimately shape outcomes. For neighborhood-level insight in Maple Valley, Black Diamond, or Bonney Lake, a localized review is always the best next step.